Biden Student Loan Forgiveness Update: Where Things Stand Currently

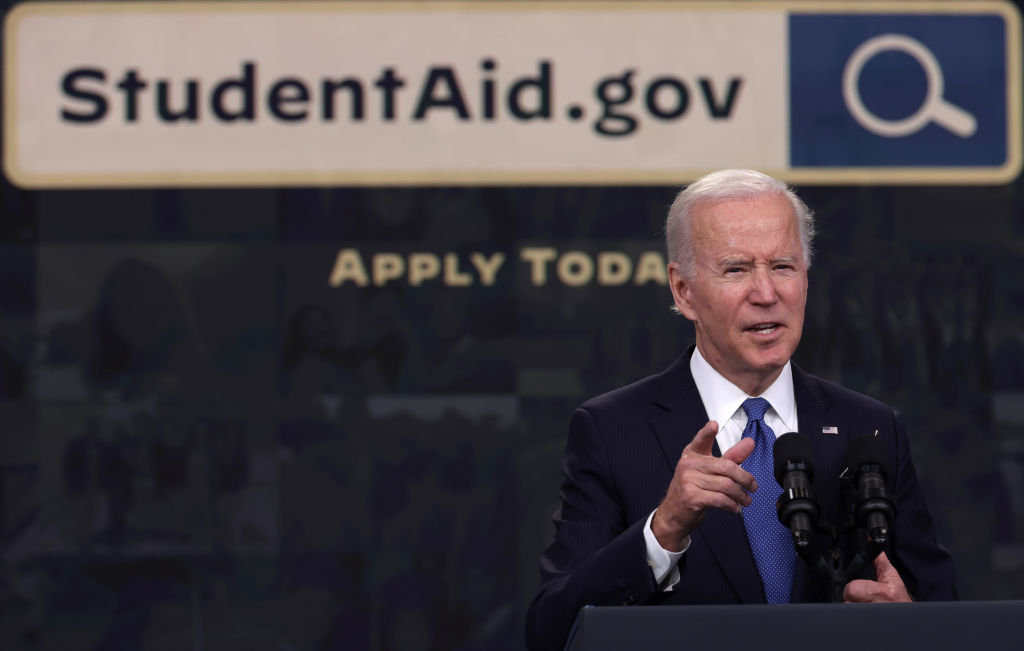

Credit: Image Credit: Alex Wong / Getty Images News / Getty Images

Credit: Image Credit: Alex Wong / Getty Images News / Getty Images- President Biden last August proposed a highly anticipated plan to erase millions in student loan debt.

- Many conservatives opposed the plan, and several conservative-led groups and states began mounting legal challenges.

- Following two lower court rulings last fall that suspended the loan cancellation program, the Supreme Court agreed to hear an appeal from the Biden administration.

- The Supreme Court blocked the debt forgiveness plan in a 6-3 decision that fell along ideological lines.

Millions of federal student loan borrowers waited patiently — sometimes impatiently — for promised loan forgiveness.

The debt cancellation saga dates back to August 2022, when President Joe Biden first announced that he intended to forgive up to $20,000 in student loan debt per borrower under an income threshold. However, many court battles culminated in the U.S. Supreme Court striking down the president’s plan in a 6-3 decision.

Here were the essential details of Biden’s proposal:

- $10,000 in forgiveness for most borrowers and $20,000 in total forgiveness for borrowers who received a Pell Grant while in school

- Only borrowers who earn less than $125,000 per year — or $250,000 for couples — can qualify for debt relief

- Only applies to loans secured before June 30, 2022

Approximately 43 million borrowers were expected to be eligible for debt forgiveness under this plan.

Soon after the U.S. Supreme Court struck down Biden’s loan forgiveness plan, the president countered with a new path toward forgiveness.

Biden in June 2023 announced that he would pursue loan cancellation through the negotiated rulemaking process. He said the Department of Education (ED) has the authority to enact debt forgiveness through rulemaking under the Higher Education Act.

With those negotiations underway, here’s a reverse timeline of events related to the student loan forgiveness plan:

September 2024 — Court Temporarily Blocks New Debt Forgiveness Plan

Attorneys general from seven states, led by Missouri, filed a lawsuit on Sept. 3, 2024, hoping to block Biden’s latest debt forgiveness plan.

Just two days later, the U.S. District Court for the Southern District of Georgia issued a temporary restraining order on the Biden administration. That order prevents ED from enforcing the Plan B forgiveness proposal, which had not been finalized at the time of the lawsuit.

The court’s decision forbids the department from offering any “mass” student loan debt cancellation. It also prevents ED from forgiving any interest balances or not charging accrued interest.

A hearing is scheduled for Sept. 18.

April 2024 — “Plan B” Debt Forgiveness Could Impact 30M Borrowers

President Biden announced in early April that if his “Plan B” debt forgiveness is finalized as proposed, it would help over 30 million federal student loan borrowers.

The largest group of borrowers that would benefit from his plan are people with loan balances that are greater now than what they originally borrowed. The Biden administration expects 23 million borrowers could have all their accrued interest wiped thanks to his proposal.

Biden’s proposal would eliminate all remaining debt for over 4 million borrowers, the White House announced.

More than 10 million would see debt relief of at least $5,000.

February 2024 — Negotiations Continue, Consensus Reached

The Biden administration reconvened negotiations for his “Plan B” debt relief plan in late February.

Conversations centered on defining how to determine whether a borrower is experiencing “hardship” so that ED can grant relief to those affected.

ED’s proposal was to collect information from borrowers on a set of 17 defined factors including household income, assets, age, debt load, and other high-cost burdens.

ED would then run the data through formulas and a “machine learning model” to determine the likelihood that a borrower would default on their debt within the next two years. If the likelihood of default is 80% or more, said borrower would qualify for forgiveness.

This mechanism wouldn’t just grant one-time relief, but could be utilized for years to come, the department said.

January 2024 — Organizations Call for More Negotiations

ED and chosen negotiators failed to reach consensus on a “Plan B” approach to federal student loan debt forgiveness.

Higher education stakeholders voiced opposition to key aspects of the department’s proposal. ED also failed to provide some important language that could dramatically expand the scope of the plan, leaving negotiators frustrated.

Sixty-seven organizations sent a letter to the department on Jan. 18 calling on ED to hold another round of negotiations in 2024.

“The department cannot wait until it is too late; it must act now and establish a fourth rulemaking session to ensure the promise of student debt cancellation happens swiftly as we embark upon a new year,” the letter read.

December 2023 — “Plan B” Debt Forgiveness Fails First Major Test

ED convened higher education stakeholders in October, November, and December to discuss a potential alternative debt forgiveness plan.

ED’s December proposal promised to be a significantly more targeted program than his 2022 plan. It would focus on high-debt borrowers, those who have been in repayment for 25 years, those who attended low-value schools, and borrowers who could have benefited from other forgiveness programs like Public Service Loan Forgiveness (PSLF).

The department also promised to address borrowers “experiencing hardship,” but it never provided a concrete plan to help those borrowers.

Negotiators were accepting of some aspects of the plan, but there was strict opposition to caps on forgiveness and an “arbitrary” cutoff date of July 1, 2005, for long-term borrowers.

ED and negotiators failed to reach consensus on the final proposal.

The department entertained the idea of holding further negotiations in 2024, but did not commit to that possibility.

June 30, 2023 — Biden Proposes Debt Forgiveness Alternative

Soon after the U.S. Supreme Court struck down Biden’s loan forgiveness plan, the president countered with a new path toward forgiveness.

Biden announced that he will pursue loan cancellation through the negotiated rulemaking process. He said ED has the authority to enact debt forgiveness through rulemaking under the Higher Education Act.

The department plans to hold a virtual public hearing to determine a rulemaking agenda on July 18.

ED would then choose and gather negotiators representing different interest groups in higher education. Negotiators would meet with the department over three months sometime this fall to craft a debt forgiveness plan.

That means any plan won’t become effective until late 2023, or potentially sometime in 2024.

June 30, 2023 — U.S. Supreme Court Rules Against Loan Forgiveness

A year-long saga to cancel student loan debt culminated in the Supreme Court’s 6-3 decision to block the president’s proposed plan.

Chief Justice John Roberts wrote the majority opinion and was joined by conservative-leaning justices Clarence Thomas, Samuel Alito, Neil Gorsuch, Brett Kavanaugh, and Amy Coney Barrett. Justice Elena Kagan penned the dissenting opinion and was joined by liberal-leaning justices Sonia Sotomayor and Ketanji Brown Jackson.

Ultimately, the court’s decision boiled down to two tenets: standing and merit.

The court ruled that Missouri, one of the states suing the federal government, had standing to sue on behalf of the Missouri Higher Education Loan Authority (MOHELA). The majority called MOHELA a “public instrumentality” of the state, therefore giving Missouri the right to sue.

Second, the majority opinion agreed with the plaintiffs that Biden’s Department of Education did not have the power to offer widespread loan forgiveness through the Higher Education Relief Opportunities for Students Act of 2003 (HEROES Act). Chief Justice Roberts wrote that while the act gives the federal government the power to make modifications to the federal student loan system, it does not allow the department to conjure new policy whole cloth.

June 2023 — Senate Rebukes Biden’s Debt Forgiveness Plan

Senators followed up the House’s attempt to block the one-time debt forgiveness plan with a rebuke of their own.

On June 1, the U.S. Senate passed a resolution to block Biden’s forgiveness plan in a 52-46 vote. Like in the House of Representatives the week before, Republicans united and voted unanimously in favor of the resolution.

Two Democrats crossed party lines to vote in favor of the resolution:

- Sen. Joe Manchin of West Virginia

- Sen. Jon Tester of Montana

Independent Sen. Kyrsten Sinema of Arizona, previously a registered Democrat, also voted in favor of the measure.

Democratic Sens. Michael Bennet of Colorado and Mark Warner of Virginia abstained from the vote.

The resolution will next head to President Biden’s desk. He already expressed his intention to veto the resolution in the past. The resolution did not pass the Senate with a veto-proof majority, so that will likely spell the end to Congress’s attempt to halt Biden’s plan before it goes into effect.

May 2023 — Resolution to Block Debt Forgiveness Passes the House

Lawmakers in the House of Representatives were forced to take a stand on debt forgiveness on May 24.

The Republican-controlled House voted in favor of passing a Congressional Review Act resolution that would block Biden’s one-time federal student loan debt forgiveness plan. The 218-203 vote saw lawmakers vote largely along party lines, but with two Democrats crossing the aisle to vote in favor of the block:

- Rep. Jared Golden of Maine

- Rep. Marie Gluesenkamp Pérez of Washington

No Republicans voted against the bill.

Fourteen members of the House abstained from a vote. That included six Republicans and eight Democrats.

April 2023 — Republicans Use Debt Forgiveness in Debt Ceiling Negotiations

Republican Speaker of the House Kevin McCarthy used Biden’s student loan debt forgiveness plan as a bartering piece in negotiations to raise the federal debt ceiling.

McCarthy introduced the Limit, Save, Grow Act of 2023 on April 19. The bill would raise the debt ceiling – therefore preventing the U.S. government from defaulting on its debt – but stop the one-time debt forgiveness plan from going into effect. It would also end the pause on federal student loan payments.

Biden quickly rebuked Rep. McCarthy’s proposal.

Ultimately, the deal to increase the debt ceiling and limit government spending passed the House and Senate but did not include an end to Biden’s one-time debt forgiveness plan.

The Fiscal Responsibility Act did, however, include a measure to to end the federal student loan payment pause by Aug. 29.

The plan cleared its final Congressional hurdle on June 1. Biden is expected to sign the act into law in the coming days, as some experts predict the U.S. will hit the debt ceiling in early June.

March 2023 — Watchdog Says Forgiveness Plan Is Subject to Congressional Review

The Government Accountability Office (GAO) on March 17 declared that Biden’s plan to wipe federal student debt must be submitted to Congress.

It’s a step ED avoided up until this point.

In submitting the rule to Congress, any lawmaker can move to strike down the rule before it takes effect. Sens. Bill Cassidy, John Cornyn, and Joni Ernst led the effort in the Senate, while Rep. Bob Good introduced a similar resolution in the House of Representatives.

Each resolution immediately attracted 39 and 41 Republican co-sponsors, respectively.

It’s unlikely such moves would make a difference because the president ultimately holds the power to veto any challenges from Congressional review; it’s unlikely there are enough opponents of debt forgiveness to override a veto.

Still, the resolutions are significant as they may result in votes in each chamber that will force politicians to choose a side or abstain.

February 28, 2023 — Supreme Court Hears Oral Arguments in the Case

The Supreme Court heard arguments on Tuesday that will ultimately decide the future of President Joe Biden’s student loan forgiveness plan.

Attorneys representing six Republican-led states hoping to block debt cancellation argued that the federal government does not have the power to cancel hundreds of millions worth of debt.

U.S. Solicitor General Elizabeth Prelogar maintained that the Department of Education (ED) does have the authority to make this move under the Higher Education Relief Opportunities for Students (HEROES) Act originally passed in 2002.

That law allows the secretary of education to “waive or modify” student financial assistance programs for those who have “suffered direct economic hardship as a direct result of a war or other military operation or national emergency.”

Oral arguments will also address a question that could block the court from even ruling on the merits of the case: Do the six states behind the challenge have the standing necessary to bring suit?

December 2022 — Supreme Court Agrees to Hear Case

The U.S. Supreme Court announced Dec. 1 that it would take on multiple cases that aim to prevent Biden’s debt forgiveness plan.

SCOTUS combined two cases and plans to hold a hearing on both on Feb. 28, 2023. The first case involves six Republican-led states claiming debt relief will decrease revenue, while the other case alleges borrowers were denied the right to protect their economic interests because the department did not go through a formal rulemaking process.

Many believe the Supreme Court will expedite its process in the case. A decision will likely come through this summer.

November 2022 — Biden Extends Loan Payment Pause

The previous pause on federal student loan payments was set to expire on Jan. 1, 2023.

Because of pending court cases, Biden moved to extend the pause yet again to July 1. He said at the time that the extension would give the U.S. Supreme Court time to take up the case on appeal.

“I’m completely confident my plan is legal. But right now it’s on hold because of these lawsuits,” Biden said.

November 2022 — Appeals Court Blocks Forgiveness Program

Biden’s legal mess truly hit a wall when the 8th U.S. Circuit Court of Appeals ruled Nov. 21 that the lawsuit involving six Republican-led states had legal standing. The court issued a preliminary injunction, blocking the president’s forgiveness plan.

This comes after a lower court tossed the case.

According to court documents, Missouri’s connection to the Higher Education Loan Authority of the State of Missouri (MOHELA) was integral in deciding whether the case had standing to proceed. MOHELA services federal loans, so Missouri is harmed by Biden’s debt relief because it would decrease the volume of loans it services, the court stated.

November 2022 — Borrowers No Longer Able to Apply for Forgiveness

The Federal Student Aid (FSA) portal to apply for student loan debt cancellation stopped accepting applications on Nov. 11.

Recent court decisions played a role in the department’s decision to remove the application from the FSA website.

“Courts have issued orders blocking our student debt relief program. As a result, at this time, we are not accepting applications,” read a message on the website that previously housed the application.

October and November 2022 — Legal Cases Ping Pong Through Courts

The first domino to fall — besides the initial filings — in the legal case against Biden’s debt relief plan came on Oct. 20. It was that day that Judge Henry Edward Autrey of the Eastern District of Missouri denied the motion for a preliminary injunction for the case brought by six Republican-led states.

In his decision, Autrey said the states could not prove ongoing injury and, therefore, had no grounds to sue ED.

The states quickly appealed the decision, and the next day, the 8th U.S. Circuit Court of Appeals granted a stay in the case. This acted as a temporary block to the department’s ability to carry out loan discharges.

A short time later, on Nov. 10, Judge Mark Pittman of the U.S. District Court for the Northern District of Texas vacated the president’s plan. His decision involved a separate case brought by the Job Creators Network Foundation (JCNF).

Pittman’s decision was based on the idea that President Biden did not have the authority to institute his plan to begin with.

October 2022 — Application Goes Live

Oct. 14 marked the first day that federal student loan borrowers could apply for debt relief.

While live, the application asked for just six pieces of information:

- First name

- Last name

- Social Security number

- Date of birth

- Phone number

- Email address

The form also asked that applicants confirm that they fall within the income threshold of $125,000 per year, or $250,000 for couples.

September 2022 — Biden Backtracks on Forgiveness for FFEL Borrowers

For a time, ED set a path for Federal Family Education Loans (FFEL) program borrowers to gain forgiveness. All they had to do was consolidate their loans into the Direct Loan program and they’d be eligible for forgiveness, experts told BestColleges.

However, that ended on Sept. 29.

All borrowers who consolidated before Sept. 29 could still have debt erased. But those who did it on that date or after would no longer be eligible, according to ED.

September 2022 — Lawsuits Filed to Block Forgiveness

It took just over a month for lawsuits challenging Biden’s plan to roll in.

The first was from the California-based nonprofit Pacific Legal Foundation (PLF) on Sept. 27. That case centered on the argument that a borrower would be harmed by automatic debt forgiveness if they live in a state that planned to tax canceled debt as income.

After ED clarified that borrowers could opt out of debt relief, a court threw out that suit.

The second and more substantial suit came on Sept. 29. This case involves six Republican-led states that will soon appear before the U.S. Supreme Court.

The six states are:

- Arkansas

- Iowa

- Kansas

- Missouri

- Nebraska

- South Carolina

The important part of this case involves MOHELA, which services federal student loans. The plaintiffs argue they will lose revenue due to the cancellation of large swatches of debt that they will no longer be able to charge interest on.

August 2022 — Forgiveness Plan Revealed

Biden unveiled his plan for student loan debt forgiveness on Aug. 24.

Rumors about a potential forgiveness program swirled around his administration for months before the announcement. But in the end, many advocacy groups praised the plan despite the long wait.

The extra $10,000 for Pell Grant recipients was a welcome surprise among many borrower advocates.

“Earning a college degree or certificate should give every person in America a leg up in securing a bright future,” ED Secretary Miguel Cardona said the day of the announcement. “But for too many people, student loan debt has hindered their ability to achieve their dreams — including buying a home, starting a business, or providing for their family.”